International Futures Help System

Domestic Closure: Total Savings, Investment, and Interest Rates

Given information about the financial accounting within government, households, and firms, it is possible to turn to total domestic economy balances and also to consider the linkages with the global financial system. We want to look in turn at savings, investment and interest rates, then begin to identify some important elements of international connections.

Foreign and total savings

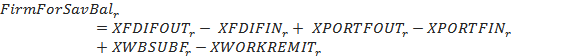

Other sections of this documentation explain the computations of government, household, and firm savings. The only element missing for the calculation of total savings is foreign savings (savings from abroad). Foreign savings is basically the flipside of the current account—remember that a deficit in the current account must be offset by an inflow of foreign savings. Hence everything that improves the current account, such as more exports, reduces the net inflow of foreign savings. In IFs foreign savings have terms from trade and aid, but also from the balances of government and firms with the outside world. For government those terms involves credits and flows to and from the IMF (XIMFCRFOUT and XIMFCRFIN) and the World Bank (XWBLNFOUT and XWBLNFIN) For firms those terms involve foreign direct investment (XFDIFOUT and XFDIFIN) and portfolio flows (XPORTFOUT and XPORTFIN) as well as subscriptions to the World Bank institutions (XWBSUBF) and worker remittances (XWORKREMIT).

![]()

where

![]()

The total savings in each country will be the sum of the individual terms. By definition it will equal investment (I), defined as capital formation (IGCF) plus inventory stock (ST) changes. Treatment of physical balances over time, not elaborated in this topic, assure that equality. Looking at the two variables side by side is a good test of the functioning of the SAM.

![]()

In other sections of this documentation we have described the computation of relative-price adjusted variables such as exports (XRPA), imports (MRPA), and GDP, potential and actual (GDPRPA and GDPPOTRPA). In addition we have relative price adjusted versions of foreign savings (FORSAVRPA) and total savings (SAVINGSRPA).

![]()

![]()

These relative-price adjusted savings variables are used for information only and do not affect financial balances or other variables. The relative-price adjusted trade, however, is taken to the trade balance (TRADEBAL) in the economic model and on to the current account balance (CURACT) in the international financial accounting and equilibration. There it will affect international debt calculations (XDEBTRPA).

Gross capital formation and investment

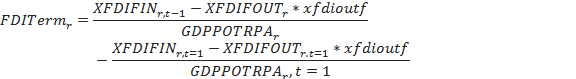

The equation below indicates that the core of the gross capital formation (IGCF) calculation each year is potential GDP (GDPPOT) times an investment rate (IRA) from the initial year. The investment rate core determination also involves input from foreign direct investment, increasing or decreasing if the FDI ratio to potential, relative price adjusted GDP changes.

![]()

where

There are multiple factors that modify that core. (See the similarities in the calculation of household consumption as having a core in permanent income, with a number of factors modifying it.) In general, those modifications help investment react to changes in savings patterns and they help maintain the equilibrium of the domestic financial system. The first is an interest rate multiplier (IRAMul) that, like the one on consumption, drives down investment when interest rates rise. In fact, the multiplier responds to smoothed and long-term interest rates exactly as consumption responds, although the parameters in the PID adjustment function make the adjustment a little less responsive. The second is one that ties investment to a smoothed version of the SAVINGS variable. As savings rise, normally investment does also, and IFs uses a moving average to smooth the impact of changes of savings rates in this relationship. The third is a direct response to excess stocks or inventories. Again this is parallel to the adjustment of household consumption to stocks, except that 1/2 of the excess stocks are passed to household consumption and only 1/6 of them are assigned to gross capital formation.

![]()

where

![]()

![]()

![]()

![]()

Additionally, there are two adjustments that reflect the changing life expectancy and/or savings patterns of the society. The first reacts to changes over time in the variation of the actual life expectancy from the life expectancy expected given the GDP per capita at PPP of a society. If that gap increases, a small portion of it increases investment rates (as it would savings rates). The second again involves life expectancy, but the purpose of it is to reflect the changing age structure of a society and the consumption/savings-investment patterns of societies with different age structures. Finally, an exogenous multiplier ( invm ) allows the user to push capital formation rates up or down.

![]()

where

![]()

![]()

![]()

Gross capital formation, although highly correlated with investment (I) is not equal to it. Investment also contains changes in stocks. It is that addition of delta stocks that brings the entire representation of the goods and services market in proper relationship with the financial representations of flows among agent classes.

![]()

Having total investment, it is also possible to compute investment by origin sector (INVS). In IFs, that spread is constant over time in the configuration of the first model year. See documentation on the goods and services market for information on investment by destination sector, IDS.

![]()

Interest rates

The SAM structure in IFs is really a combination of an accounting system and an equilibrating system. Just as the equilibrating mechanisms discussed above are important, it is critical to make sure that the accounting balances are maintained. One good measure of ultimate balance is the required, conceptual equality of total savings and investment. Their equality, in fact, is also reassurance that the goods and service market elements of the model are fully integrated with the broader financial ones.

Just as changes in real relative prices by sector help the goods and services market chase equilibrium across time (using build-up or run-down of stocks or inventories to change prices and send signals to supply and demand sides of the model), changes in real interest rates (INTR) send signals to consumption and investment in order to allow the system to chase equilibrium between savings and investment/consumption over time. IFs does not maintain a monetary sector that would introduce nominal interest rates (or nominal prices).

IFs slows down change in interest rates by making them responsive to the average of a term that is directly responsive to inventory levels and the interest rate in the preceding year. It further anchors interest rates in the responsive term to the real interest rate of the initial model year (because this is set at a stylized rate of about 3 percent rather than to actual nominal rates in the initial year, the anchor does not need to converge to a long-term target level). The responsiveness comes from a ratio of a sum across all sectors of the desired stocks (a stock base, STBase, times a parameter of desired stock rates, dstl ) to a sum across sectors of the actual stocks (ST). Because the denominator in the ratio could become inappropriately small, it is bound so as to be at least 30 percent of desired stocks. See documentation on changes in relative prices for more information on the stock base and the general approach. Interest rates rise as stocks fall relative to desired levels and fall as stocks rise above those desired levels.

![]()

where

![]()

Even with the smoothing of the above equation, a model of long-term behavior like IFs benefits from some further smoothing of the interest rates before they feed back to the consumption and investment patterns. Two smoothed terms (a very long-term interest rate, LongTermIntr, and a smoothed rate, SmoothedIntr) moderate the impacts of real interest rates and allow somewhat more variation in them.

![]()

![]()

International Futures at the Pardee Center

International Futures at the Pardee Center