International Futures Help System

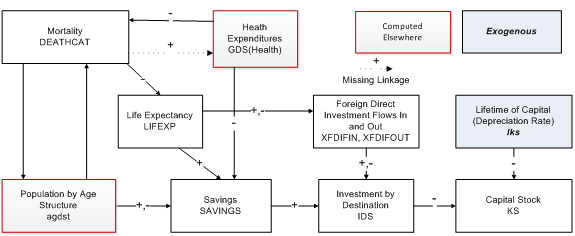

Forward Linkages of Health to Capital Stock

The figure below sketches the primary paths between health (morbidity and mortality) and capital stock. Most capital stock consists of buildings and machinery for producing goods and services; some representations may include land also, but most treat land separately and largely as a constant (although land developed for crop production or grazing can, in fact, be highly variable, as it is in the IFs agricultural model). Most immediately, investment increases capital stock and depreciation reduces it. Although there is certainly some impact of morbidity and mortality on the rate of depreciation of both built physical and natural capital, the relationship may not be substantial and we do not understand it well enough to model it. Investment is responsive to both domestic savings and foreign flows.

Turning our gaze to the paths by which health affects investment, the three major ones run though health spending, which can crowd out savings and investment, through the age-structure of societies, which affects the savings rate, and through investment from abroad, which can augment that generated domestically.

With respect to health spending, to which we return later, the IFs model uses a social accounting matrix (SAM) structure. Thus the flow of funds into health spending automatically competes with other consumption uses and with savings and investment. The major current weakness of the model with respect to this path is that there is no linkage from morbidity (associated in IFs with mortality) and health expenditures. (There is a linkage in IFs back from health spending to mortality –all categories except for AIDS).

The paths in IFs that link age structure most directly to domestic savings have two important elements. The most fundamental one represents the understanding of life-cycle dynamics in income, consumption and savings. The cycle for income is fairly clear-cut with a peak in the middle to latter periods of the working years. Workers set aside some portion of income as savings and that portion, too, tends to peak in the middle and late period of working years. Society-wide savings themselves become negative after retirement age (65 in the Base Case scenario but variable in scenarios) even though some portion of the population will continue to work. The second fundamental element is that both the horizon of life expectancy and the average income level of a society can have an impact on the portion set aside for savings and the degree to which it rises and then falls. Thus, for example, the life-cycle “bulge” of savings may be earlier and flatter in developing countries.

We implemented the representation of savings and investment in accord with that understanding. Relying upon analyses of selected countries that Fernández-Villaverde and Kruegger (2004 and 2005) and Deaton and Paxson (2000) undertook, we extracted general stylized patterns of the savings life cycle to represent more and less developed (and lower life expectancy) countries. In forecasting we use the pattern for less developed countries when life expectancy falls below 40 years, use that for more developed countries when life expectancy exceeds 80 years, and interpolate in between for all other countries. The result of this largely algorithmic approach [1] is an adjustment factor (SavingsAgeAdj) that augments or reduces investment.

In addition, investment is somewhat augmented or reduced as a direct result of changing life expectancy. Life expectancy is compared over time with an expected value (tied to cross-sectional estimation with income). That difference is compared to the difference in the initial year and, if it rises, augments investment.

Although conceptually tied to savings rates, neither the life-cycle analysis nor the life-expectancy term directly affect savings in IFs. Instead, they affect investment directly and savings indirectly via the dynamics in IFs that balance savings and investment over time.

The path linking health to foreign direct investment is potentially quite important. Alsan, Bloom and Canning (2006: 613) reported that one additional year of life expectancy boosts FDI inflows by 9 percent, controlling for other variables. We have implemented that relationship in IFs. The representation of FDI in IFs captures the accumulation over time of FDI inflows in stocks of FDI, as well as the accumulation of FDI outflows in stocks. In addition, the stocks set up their own dynamics, including the tendency for stocks to reinforce flows. For that reason, we have set the base case parameter for the impact of each year of life expectancy on FDI flows to 0.05 (5 percent), lower than the estimate of Alsan, Bloom and Canning (2006).

[1] See the subroutine SavingsDemogAdj in routine Populat.bas, which draws upon table IncConSav in IFs.mdb with different patterns of income, consumption, and savings for more developed countries (MDCs) and less developed countries (LDCs) across age categories; in general, peaks of income, consumption, savings occur the in late 40s and savings turn negative at 65.

International Futures at the Pardee Center

International Futures at the Pardee Center