International Futures Help System

Energy Prices and Final Adjustments to Domestic Energy Stocks and Capacity Utilization

IFs keeps track of separate domestic, ENPRI, and world, WEP, energy price indices, that apply to all forms of energy. These are initialized to a value of 100 in the first year. It also tracks the world energy price in terms of dollars per BBOE, WEPBYEAR, which is initialized as a global parameter.

A number of pieces are needed for the calculation of energy prices. These include a world stock base, wstbase, world energy stocks, wenst, world energy production by energy type, WENP, world energy capital, WorldKen, and a global capital output ratio, wkenenpr. These are calculated as follows:

![]()

![]()

![]()

![]()

![]()

where

- ENSHO is domestic energy shortage (described below)

- ken is capital for each energy type

- lke is the average lifetime of capital for each energy type

In cases when at least one country has an exogenous restriction on the production of oil, i.e., enpm(oil) < 1 for at least one country, a few additional variables are calculated:

![]()

![]()

![]()

Otherwise these three variables all take on a value of 0.

These values are used to calculate an adjustment factor driven by global energy stocks that affects domestic energy prices. The effect in the current year, wmul, is calculated using the ADJSTR function, which looks at the difference between world energy stocks, wenstks and the desired level, given by dstlen * wstbase, and the change in world energy stocks from the previous year. The presence of an exogenous restriction on the production of oil has two effects on the calculation of wmul. First, the value of ShortFallSub affects the two differences that feed into the ADJSTR function. Second, the elasticities applied in the ADJSTR function are tripled.

The adjustment factor calculated in the current year is not applied directly to the calculation of domestic energy prices. Rather, a cumulative value, cumwmul, is calculated as:

![]()

Other factors affect the domestic energy price index – domestic energy stocks, possible cartel price premiums, encartpp , the first year value of the world energy price index, IWEP, changes in the global capita output ratio from the first year, whether the user has set a global energy price override. enprixi, and whether there are any restriction on oil production.

The domestic energy stocks affect a country-specific “markup” factor, MarkUpEn. This starts at a value of 1 and changes as a function of the value of mul, which is calculated using the ADJSTR function. Here the differences are those between domestic energy stocks and desired stocks, given as dstlen * StBase, and the changes in energy stocks from the previous year. Shortages from the previous year are also taken into account. The user can also control the elasticities used in the ADJSTR function with the parameters epra and eprafs . This markup evolves over time as

![]()

The domestic energy price index, ENPRI, is first calculated as:

![]()

where

- X = enprixi, when this parameter is set to a value greater than 1 and IWEP otherwise

It is then recomputed as:

![]()

where

- X is 100 whenthere is a restriction on oil production in at least one country and 20 otherwise

Furthermore, ENPRI is not allowed to fall by more than 10 in a given year.

It is possible for the user to override this price calculation altogether. Any positive value of the exogenous country-specific energy price specification ( enprix ) will do so.

It is only now that a country’s energy stocks and shortages are finalized for the current year. If ENST is less than 0, then a shortage is recorded as ENSHO = -ENST and ENST is set to 0. In addition, for countries that have a low propensity for exports, XKAVE < 0.2, a share of any global shortfall is added to their shortage, with the share determined by the country’s share of moving average energy demand among those countries:

![]()

The energy shortage enters the Economic model in the calculation of gross sectoral production.

The same differences in domestic stock from their target level and their change since the previous year, taking into account shortages from the previous year, are used to update the value of capacity utilization in energy, CPUTF, which was introduced earlier. The multiplier affecting CPUTF, Mul, is calculated using the ADJSTR function, with elasticities given by elenpst and elenpst2 . In addition, the capacity utilization is smoothed over time.

![]()

This value is further assumed to converge to a value of 1 over a period of 100 years and is bound to always have a value between 0.2 and 2.

This still leaves the need to calculate the world energy price. IFs actually tracks a world price including carbon taxes, WEP, and a world price ignoring carbon taxes, WEPNoTax. Carbon taxes are ignored in cases where the energy price is set exogenously using enprix .

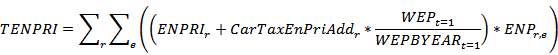

In both cases, the world energy price is a weighted average of domestic energy prices:

![]()

![]()

where

![]()

![]()

where

- WEP and WEPBYEAR convert CarTaxEnPriAdd from $/BBOE to an index value

- the term with CarTaxEnPriAdd is ignored in countries with exogenous energy prices in a given year

- CarTaxEnPriAdd is

Finally, the value of WEPBYEAR is computed as:

![]()

International Futures at the Pardee Center

International Futures at the Pardee Center