International Futures Help System

Government Accounts

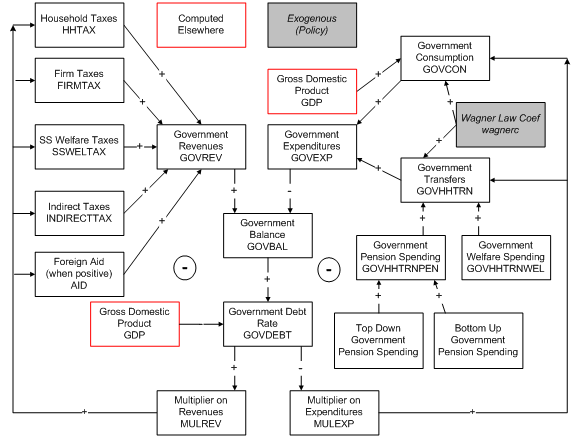

Government revenues come from taxes levied on households and firms. The total expenditures are a sum of two sub-categories, direct consumption and transfer payments (the latter in turn being a sum of payments for pensions/retirement and welfare.

The annual government balance is the difference between revenues and expenditures and increments or decrements government debt in absolute terms and as a portion of GDP. That stock variable in turn sends back signals to both revenue and expenditure sides of the model so as to keep the debt at reasonable levels over time.

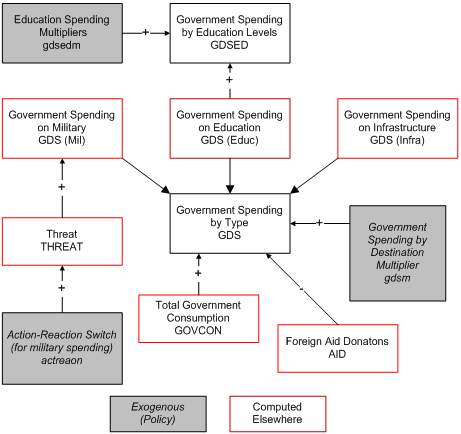

The level of government consumption and its distribution across targets are important policy-relevant variables in the model. Government consumption is spread across several target spending categories: military health, education, traditional infrastructure, other infrastructure, research and development, other/residual, and foreign aid). The distribution to most of those categories is endogenously determined by functions, but other models in the IFs system provide special signals for military, education, and traditional infrastructure spending. Demand for military spending involves action-reaction dynamics (when a switch is turned on) and threat levels. Demand for educational and infrastructure involves full models. Demands will not equal supply and all demands are normalized to the supply, but special protection can be given to the demands for education and infrastructure spending.

Educational spending by level of education (primary, secondary, and tertiary) is further broken out of total educational spending in the education model but targets can be changed via a multiplier.

International Futures at the Pardee Center

International Futures at the Pardee Center