International Futures Help System

Energy Investment

Investment in energy is relatively complex in IFs, because changes in investment are the key factor that allows us to clear the energy market in the long term. It is also different and perhaps slightly more complex in IFs than investment in agriculture. Whereas the latter involves computing a single investment need for agricultural capital, and subsequently dividing it between land and capital, in energy a separate demand or need is calculated for each energy type, based on profit levels specific to each energy type.

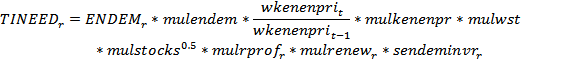

We begin by calculating a total energy investment need (TINEED) to take to the economic model and place into the competition for investment among sectors. This investment need is a function of energy demand, adjusted by a number of factors, some global and some country-specific. To begin with, TINEED is calculated as

where

- mulendem is the ratio of global energy demand per unit GDP in the current year to that in the previous year

- wkenenpri is the ratio of global energy capital to global energy production

![]()

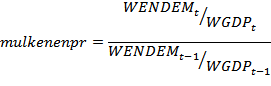

- mulkenenpr is the ratio of wkenenpr in the current year to that in the previous year

![]()

- mulwst and mulstocks are factors related to global energy stocks. mulwst is calculated using the ADJSTR function, where: the first order difference is that between global energy stocks, wenstks, and desired global energy stocks, DesStocks = dstlen * wstbase; the second order difference is between the level of world energy stocks in the current year and those in the past year; and the elasticities are given by the parameters elenpr and elenpr2 . mulstocks is also related to global energy stocks, but is more directly related to the desired level of global energy stocks:

![]()

Note that mulstocks will always take on a value between ¼ and 4.

- mulrprof is a function of the expected level of profits in the energy sector as a whole in a country, EPROFITR. Energy profits are calculated as the ratio of returns, EnReturn, to costs, ProdCosts. EPROFITR is actually a moving average of these profits relative to those in the base year, with a historical weighting factor controlled by the parameter eprohw . In full, we have:

![]() [1]

[1]

![]()

![]()

![]()

We can now calculate mulrprof using the ADJSTR function. The first order difference is between the current value of EPROFITR and a target value of 1; the second order difference is the change in the value of EPROFITR from the previous year; the elasticities applied to these differences are given by the parameters eleniprof and eleniprof2 .

- mulrenew is a function of the share of other renewables in the energy mix in a country. It is assigned a value of 1 unless the production of energy from renewables exceeds 70% of total energy demand. If so, we have:

![]()

Given these conditions, mulrenew can take on values between 0.5 and 1, with larger values associated with larger amounts of renewable production.

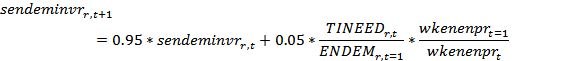

- sendeminvr is a moving average of the ratio of investment need to energy demand in a country, with an accounting for changes in the global capital production ratio since the first year and is updated as[2]:

After this initial calculation, two further adjustments are made to TINEED. The first is a reduction related to a possible reduction of inventory, invreduc, carried over from the previous year. The calculation of invreduc is described later in this section, where we look at reductions in investment in specific energy types due to resource constraints or other factors. The effect on TINEED is given as:

![]()

Thus, the reduction in TINEED can be no more than 60 percent.

Finally, the user can adjust TINEED with the use of the multiplier eninvm .

Before this total investment need, TINEED, is passed to the Economic model, there is a chance that it may need to be further reduced. This depends on the calculation of a bound, TINeedBound. TINeedBound arises from a bottom-up calculation of the investment needs for each energy type individually, ineed. These depend upon the profits for each energy type and any possible bounds on production related to reserves and other factors.

As with the estimate of total profits to energy, the returns by energy type depend upon production and costs.

![]()

For the non-fossil fuel energy types – hydro, nuclear, and other renewable – EnCost is based solely on capital depreciation

![]()

where

- e = hydro, nuclear, renew

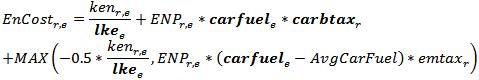

For the fossil fuel energy types – oil, gas, and coal – we must also consider any possible carbon taxes. EnCost is calculated as

where

- e = oil, coal, gas

- carfuel is the carbon content of the fuel in tons per BBOE

- AvgCarFuel is the unweighted arithmetic average of the carbon content of oil, gas, and coal

- carbtax is an exogenously specified country-specific carbon tax in $ per BBOE

- emtax is the number of years since the first year plus one multiplied by 2

The change in eprofitrs from the first year is then calculated as:

![]()

An average return, avgreturn, is calculated as the weighted sum of the individual returns:

![]()

Investment need by energy type, ineed, grows in proportion to capital and as a function of relative profits.

![]()

where

- elass are country and energy-specific user controlled parameters

At this point, ineed is checked to make sure that it does not fall by more than 20% or increase by more than 40% in any single year.

Also, if the user has set an exogenous target for production growth, i.e., eprodr > 0, all of the above is overridden and ineed is calculated as:

![]()

These investment needs are checked to make sure that they do not exceed what the known reserve base can support. This applies only to oil, gas, coal, and hydro. An initial estimate of the maximum level of investment is given by:

![]()

where

- e = oil, gas, coal, or hydro

The first term in parentheses, when multiplied by QE, indicates the amount of capital that would be necessary in order to yield the maximum level of production given the lower bound of the reserve production ratio, prodtf . The second term is simply the current level of capital and the third term indicates the level of depreciation of existing capital. This implies that countries will not make investments beyond those that would give it the maximum possible level of production for a given energy type.

At the same time, IFs assumes there is a minimum level of investment, which is basically 30% of the capital depreciated during the current year:

![]()

where

- e = oil, gas, coal, or hydro

In cases where the current production of oil, gas, or coal already equals or exceeds the exogenously specified maximum for a country – enpoilmax , enpgasmax , or enpcoalmax – maxinv is set equal to mininv. This again avoids useless investment.

A further constraint is placed on the maximum investment level in capital for hydro production. This is done by simply replacing RESER/ prodtf in the calculation of maxinv with the value ENDEM * EnpHydroDemRI * 2, where EnpHydroDemRI is the ratio of energy produced by hydro in the base year to total energy demand in that year. In other words, the growth in energy production from hydro in the current year from the first year cannot exceed twice the growth in total energy demand over that period, even if reserves are available, and capital investments are restricted accordingly.

![]()

The constraints placed on investment in nuclear energy differ somewhat from these other fuels. IFs does not have an explicit measure of reserves for nuclear. Rather, it is assumed that the growth in capital in nuclear energy cannot exceed 1 percent of existing capital plus whatever is required to account for depreciation:

![]()

where

- e = nuclear

Also, the minimum level of investment for nuclear energy is assumed to be 50 percent of the capital depreciated in the current year, rather than 30 percent as with oil, gas, coal, and hydro.

There is no limit to the investments in capital for other renewables.

Given these restrictions, the investment needs for oil, gas, coal, hydro, and nuclear are updated so that mininv <= ineed <= maxinv. Any reductions from the previous estimates of ineed are summed across energy types to yield the value of invreduc, which will affect the estimate of TINEED in the following year as described earlier.

The final estimates of ineed for each energy type are summed to yield TINeedBound. If TINEED is greater than TINEEDBOUND, then TINEED is recalculated as the average of the two:

![]()

This value of TINEED is passed to the Economic model as IDSenergy,

![]()

where

- sidsf is an adjustment coefficient converting units of energy capital into monetary values. This gradually converges to a value of 1 after a number of years specified by the parameter enconv .

In the Economic model, the desired investment in energy must compete with other sectors for investment (see more about linkages between the Energy and Economic models in section 3.7). Once these sectoral investments are determined, a new value for investments in the energy sector, IDSs=energy, is passed back to the Energy model. The adjustment coefficient is then applied to yield:

![]()

In the meantime, the desired investment for each energy type can be modified with a country and energy-type specific parameter eninvtm , and a new value of TINEED is calculated as the sum of these new levels of desired investment. The amount of the available investment, inen, going to each energy type is then calculated as:

![]()

i.e., all energy types receive the same proportional increase or decrease in investment.

These investments are then translated into units of capital, KEN_Shr,

![]()

The new level of capital is determined as:

![]()

where

- CIVDM is an exogenous factor reflecting civilian damage from war

Note that there is no guarantee that KEN_Shr is positive, so it is theoretically possible for ken to fall below 0; IFs checks to make sure that this does not happen.

[1] World energy price is used to provide stability. The no tax world energy price is used as taxes do not contribute to returns.

[2] Note the careful use of the time subscripts. sendeminvr is not updated until after the computation of the initial value of TINEED, so the initial calculation of TINEED needs to use the previous year’s value of sendeminvr. Furthermore, the updating of sendeminvr occurs after TINEED has been adjusted to reflect any inventory reductions, but before the investment multiplier, eninvm , is applied.

International Futures at the Pardee Center

International Futures at the Pardee Center